Blunomy brief: June 2025

Welcome to the first edition of Blunomy’s monthly newsletter! We’ll be sharing insights from across our areas of expertise as well as market news and updates on interesting work we’ve been part of and events we’re involved in.

Datacentres: the rising energy burden of AI

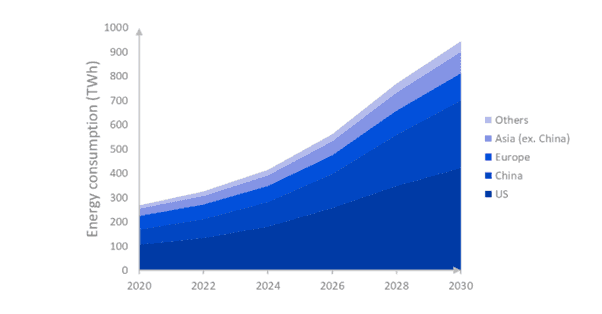

Datacentre electricity consumption by region, Base Case, 2020–2030, in TWh (Source: IEA)

AI is reshaping the datacentre landscape, driving rapid growth in the numbers of power-hungry GPUs in datacentres and leading to sharply higher energy intensity per rack.

Operational emissions dominate, but nearly a quarter of emissions are locked in from the start — through materials, design, and construction choices.

Cooling is becoming a critical pressure point: thermal loads are surging, yet many facilities still rely on outdated, high-GWP refrigerants.

Blunomy identified 10 priority decarbonisation levers, spanning energy sourcing, infrastructure choices, and thermal management — offering pathways to cut both operational and embodied emissions.

Battery boon: French tariffs could boost storage

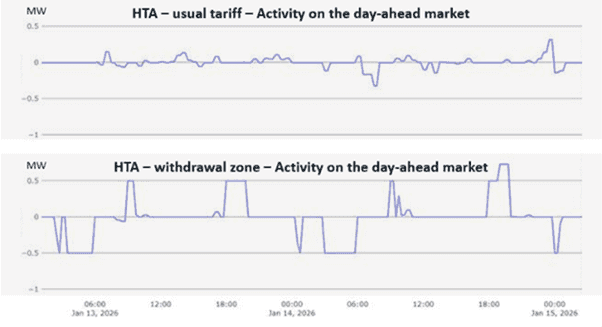

Extract of Orbit results on a winter week, where we see much more arbitrage for the battery in a withdrawal zone, with positive arbitrage blocks (i.e. injection) during peak hours.

Last November in France, the CRE (Energy Regulation Commission) consultation on new tariffs for batteries in defined withdrawal and injection zones took place. Using Orbit, our team analysed the impact of these new tariffs over 3 years (August 2025 to August 2028).

The results showed significant change in the behaviour of batteries over winter months, capturing more revenues on the day-ahead market. Overall, modelling projected 6–13% higher annual revenues for batteries in withdrawal and injection zones in comparison to those on normal tariffs.

Green pulse

Recent deals and market developments that have caught our eye.

- 🟢 H2 | RWE & TotalEnergies hydrogen deal underscores need for subsidies: RWE secured a 15-year offtake agreement with TotalEnergies to supply 30 kt/year of renewable hydrogen to the Leuna refinery starting in 2030, as part of a broader plan to decarbonise its refining operations. The deal is a textbook case of how public support mechanisms remain essential to bridging cost/price gaps. RWE received a government grant covering 70% of the project’s funding, while TotalEnergies will benefit from Germany’s THG transport credit scheme.

- ☀️ Renewables | Ramp up of renewables in France gathers speed: Five Arrows Sustainable Investments, the alternative assets arm of Rothschild & Co., recently invested in Emeraude Solaire. Emeraude Solaire specialises in mid-scale PV installations with an emphasis on self-consumption use cases for agricultural and industry customers, supporting electrification and decarbonisation while minimising direct impacts on the grid. Blunomy was proud to have supported this deal with strategic due diligence.

- 🌱 Green fuels | China surges ahead in decarbonised methanol: China is emerging as the global frontrunner in decarbonised methanol production. Decarbonised methanol is a critical solution for greening sectors like shipping, chemicals, and potentially aviation with 2 million tonnes of new capacity under construction — shipping majors including Maersk, CMA CGM and Hapag-Lloyd have committed to methanol-powered fleets. But while global demand grows, supply remains limited. Competitive pricing and volume availability are driving long-term offtake deals with Chinese producers, as European output struggles to keep pace (< 300 kt in development). Reports suggest Chinese pricing could undercut EU production, though these figures may be overly optimistic.

- 🔋 BESS | German flexibility platform terralayr blazes a trail on virtual tolling in Europe: Germany’s terralayr recently signed tolling deals for 55 MW for 7 years with Vattenfall and 50 MW / 100 MWh for 5 years with RWE. Revenue visibility has been a challenge recently for battery platforms looking to raise funds on the back of a highly-merchant revenue stack. The deals signed by terralayr, which aggregates both third-party and owned battery energy storage assets, differ from the norm because rather than handing over 100% control of a specific asset they provide access to a slice of a ‘virtual battery’ built up using capacity drawn from many assets.

Blunomy news

- Orbit’s brand-new website launched: Blunomy’s tool to accurately predict revenues for battery storage launched its website earlier this month, making it even easier for our clients in the energy and finance sectors to make the investment case.

- Shaping the APAC sustainable economy conversation: One of our transition experts, Francesca Ng, took part in an insightful webinar hosted by Eco Business and AXA Climate to discuss how Hong Kong can build a resilient workforce for a sustainable economy. In Francesca’s words: “The trick is to tie sustainability to your team’s top priorities — then they’ll be motivated to create business value in their respective roles.”

- The annual MIX.E conference in Lyon played host to some great discussions: This year Blunomy was a sponsor for this thriving event, with a compelling blend of technical updates and business discussions. If you weren’t able to make it, many of the sessions are available as audio recordings on YouTube — and maybe make a note in your diary for next year! YouTube playlist

- Vision will be at CIRED 2025 this month: CIRED’s annual conference runs 16–19 June 2025 in Geneva, and Vision, Blunomy’s SaaS for network forecasting and planning in the age of distribution systems operators and widespread consumer energy resources, will be exhibiting. Catch the team at stand Q9!